Chemicals

Order Cloned ATM Bank Cards Online

Order Cloned ATM Bank Cards Online.Card Cloning

Cloned credit cards Order online.

Meaning, Examples, & How to Prevent It

Buy clone cards online discreetly

Order Cloned ATM Bank Cards Online.Increasingly, people use credit and debit cards to store and transmit the information required for transactions. As an illustration, the world’s top 6 credit card brands (Visa, UnionPay, Mastercard, American Express, JCB, and Discover) accounted for over 440 billion purchase transactions worldwide in 2019.

Unfortunately, this makes these cards attractive targets for criminals looking to commit fraud. One way they do so is through card cloning.

Here, we’ll cover what card cloning is, how it works, and how to prevent it.

What is Card Cloning?

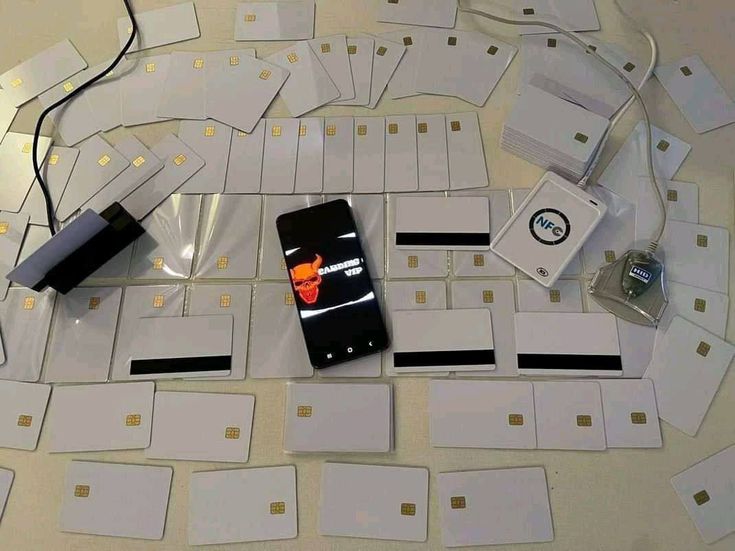

Card cloning is a type of fraud in which information on a card used for a transaction is covertly and illegally duplicated. Basically, it’s a process thieves use to copy the information on a transaction card without stealing the physical card itself.

Order Cloned ATM Bank Cards Online

This information is then copied onto a new or reformatted card, allowing criminals to use it to make fraudulent purchases or gain unauthorized access to a person’s accounts.

The most widespread version is credit card cloning, though debit card cloning is also common. Any type of card that can be used to authorize a payment or account access – even a gift card – could be a target for card cloning.

How Does Card Cloning Work?

The most common form of card cloning is known as “skimming” and generally works like this:

- Criminals install a “skimmer” – a credit card cloning machine that secretly reads and copies card information – in an ATM or point-of-sale terminal.

- A customer’s card is fed through the card reader on the ATM or POS device (to facilitate the transaction) and the skimmer (to copy the card’s information).

- The criminals retrieve the information copied by the skimmer.

- The criminals can then use the stolen information as-is to commit fraud, copy it to a fabricated or stolen card (i.e. card cloning), and/or sell it on the black market.

So how does card cloning work in a technical sense? Payment cards can store and transmit information in several different ways, so the tools and methods used to clone cards can vary depending on the situation. We’ll explain below.

Order Cloned ATM Bank Cards Online

Card Cloning: Everything You Need to Know (2025)

The answers to all your questions about card cloning and how to stay safe.

Card cloning is a major concern for banks and cardholders alike. According to the FBI, this type of fraud costs consumers and financial institutions an estimated $1 billion every year. Fraudsters go to considerable lengths to clone cards, even installing fake ATMs behind ones, and as the way we pay changes, they might not even need your card to steal from you.

What is card cloning?

Card cloning is the act of copying a debit or credit card’s payment details onto a duplicate “clone card.” These clone cards can then be used for fraudulent payments at the expense of the original cardholder.

As the way we pay changes, fraudsters are using evolving methods to keep stealing cardholders’ money. This type of fraud may often go unnoticed and carries serious risks of landing people in heavy debt or ruining their credit scores without their knowing it. With card cloning being one of the most common types of card theft and reported incidents on the increase, it’s important to understand how criminals operate so you can stay safe.

What is a clone card, and how is it used?

Clone cards are duplicate payment cards. These can be duplicate credit cards, debit cards, or even gift cards. They’re made by taking the details from a legitimate card and copying them onto an illegitimate one (e.g., onto its magnetic strip). In function, these work in the same way as the genuine card and payments made with them will be taken out of the original cardholder’s bank account.

Depending on what information the fraudsters have (e.g., PIN/CVV), clone cards can be used for everything the original card could, from buying a cup of coffee and a croissant in a cafe to buying luxury designer goods. Due to the criminal nature of clone cards, criminals may often favor taking out hard-to-trace cash, buying untraceable gift cards, or purchasing goods with a high resale value, such as luxury products.

How does card cloning work?

Fraudsters use a range of strategies to clone cards, putting cardholders at risk of card cloning, whether they are taking out cash from an ATM or entering their card details for an online purchase.

In general, card cloning consists of copying a cardholder’s details and then putting these details onto a duplicate card. Fraudsters also often try to learn cardholders’ PINs or CVV codes to use their cards in more situations and defraud victims of even more money. Fraudsters may use these cards themselves or sell them to other criminals via marketplaces on the dark web.

One of the easiest ways to clone a card is to use a “skimming” device. These read the information on the magnetic strip in cards, which functions in a similar way to a cassette, and offers no encoding protection. Many cards now also include EMV chips, which make it harder for criminals to clone a card, but it is still possible by a chip-reading process known as “shimming”.

Order Cloned ATM Bank Cards Online

Here’s how card cloning typically works:

1. Preparation: Fraudsters may attach a skimming or shimmer device to ATMs, point-of-sale (POS) terminals, or even recruit accomplices like restaurant servers to help obtain credit and debit card information.

2. Obtaining card details: Skimming devices secretly read and copy the card’s magnetic stripe data when inserted or swiped, while shimming is a more advanced method that detects EMV chip data. Fraudsters may also take advantage of compromised websites or networks to obtain online card payment details.

3. Capturing extra information (PIN/CVV): Fraudsters may go on to use hidden cameras, fake keypads, or even just watching over a shoulder to record PINs. They may use phishing or malware to steal CVV codes for online transactions.

4. Creating clones: Criminals can now program a blank magnetic stripe card (this could even be a previously stolen card) with the captured card details, creating a counterfeit duplicate of the original card.

5. Making fraudulent transactions: Fraudsters may withdraw cash from ATMs and make transactions online or in-store, or even sell the card to another criminal, all at the cost of the cardholder. Fraudsters tend to act quickly, making it harder for banks and authorities to trace the criminals.

Common methods used for cloning cards

Common card cloning methods include:

- Card skimming: Criminals install a skimming device on ATMs or POS terminals to capture magnetic stripe data when a card is swiped. Customers need to be careful when paying at POS terminals as they can easily be tampered with. For example, a huge number of skimmers has been found in 2025 all over Virginia in what seems to be a coordinated campaign of card fraud.

- Shimming: Criminals insert a more advanced “shimmer” into a card reader, allowing them to intercept EMV chip card data.

- Overlay keypads: Criminals are known to place fake keypads over real ones to record PINs entered at ATMs or other payment terminals, allowing them to find out PINs. These scams are widespread. For example, a compromised ATM scam was uncovered in Beaumont, Texas, in 2024, with criminals having been found to defraud cardholders of $10,000.

- Fake ATMs: Fraudsters have even been known to set up counterfeit ATMs solely designed to capture card details and PINs.

- RFID/NFC theft: With the rise of contactless technology, criminals can now stand close to victims and use RFID scanners or mobile apps to steal card data from contactless payment cards.

- Insider fraud: Criminal employees at stores, restaurants, or anywhere else with POS terminals may steal card details during transactions.

- Fake online stores: Fraudsters can create fake online stores or even hack real ones to steal card details at checkout.

- Social engineering scams: Scammers often impersonate government agencies, banks, businesses, and loved ones to trick victims into giving them their card details.

- Card cloning forums: Criminals may trade stolen card details or offer cloning services via forums.

- Data breaches & dark web purchases: Hackers and fraud rings steal huge volumes of card data from retailers and other payment processors, often selling these in bulk on the dark web for card cloning purposes. A major scandal hit British Airways in 2018, when it was found that 380,000 transactions had been compromised. Criminals had captured user data without disrupting their experience, allowing them to potentially clone their cards and sell their details on the dark web.

- Phishing: Criminals are known to trick users into entering their card details on fake websites via phishing scams.

- Malware: Criminals may send malware to unsuspecting victims via email to log keystrokes and help capture personal information like passwords and card details.

Order Cloned ATM Bank Cards Online

Suggested read: Payment Fraud Guide 2024: Detection and Prevention

Is card cloning illegal?

Yes, card cloning is illegal worldwide. Penalties vary from jurisdiction to jurisdiction, depending on the offense. Here are a few examples:

| Country/Region | Card cloning penalties |

| United Kingdom | Individuals convicted of credit card fraud, including card cloning, may face imprisonment of up to 10 years, fines, or both under the Fraud Act 2006. |

| United States | Individuals convicted under federal laws like 18 US Code § 1029, addressing fraud involving credit and debit cards, may face fines up to $250,000 and imprisonment of up to 10 years. |

| European Union | Although penalties vary across EU member states, credit card fraud is a serious crime across the EU, with penalties including imprisonment and heavy fines. |

| Singapore | The Computer Misuse Act (CMA), Chapter 50A, criminalizes unauthorized access to computer systems, including hacking or skimming devices to obtain card data, with penalties up to 7 years imprisonment or fines up to SGD 50,000.Penal Code, Section 420, covers cheating and dishonestly inducing delivery of property (e.g., using cloned cards), with penalties up to 7 years imprisonment and fines.Payment Services Act (2019) regulates payment systems and imposes obligations on financial institutions to prevent fraud, indirectly supporting anti-cloning measures. |

| Australia | Under the Criminal Code Act 1995 (Commonwealth): Using a device to obtain or deal with identification information (e.g., card data) without consent is an offense, punishable by up to 7 years imprisonment (Section 480.4). Unauthorized access to or modification of restricted data (e.g., via skimmers) carries up to 2 years imprisonment (Section 477.2).State laws also cover cloned cards. For example, under the Crimes Act 1900 (NSW), fraudulent use of cloned cards falls under theft or deception offenses, with penalties up to 7 years imprisonment. |

| Canada | Under the Criminal Code of Canada: Theft, forgery, or misuse of credit card data (including cloning) is punishable by up to 7 years imprisonment (Section 342).Fraud involving cloned cards carries penalties up to 14 years for large-scale offenses or 2 years for lesser cases (Section 380).Identity theft, including obtaining card data for cloning, is punishable by up to 5 years imprisonment (Section 402.2). |

| Brazil | Under the Brazilian Penal Code (Decree-Law No. 2,848/1940):Theft, including electronic theft of card data, carries 1-4 years imprisonment plus fines (Article 155).Fraud, such as using cloned cards, is punishable by 1-5 years imprisonment and fines (Article 171). |

Can cloned cards be traced?

Yes, cloned cards can be traced. Banks and financial institutions use fraud detection systems to detect unusual patterns, such as where payments are being made and if a card is being used in multiple locations.

ATM logs and POS system records, as well as camera footage, can also be used to trace cloned cards and break up criminal networks. EMV chips also generate transaction codes, which make fraudulent transactions easier to detect. IP addresses, device details, and location can also be traced for online transactions.

Order Cloned ATM Bank Cards Online

However, detection can be complicated by the use of money mules and prepaid cards. VPNs can also lead to difficulties, as can international criminal rings operating across different jurisdictions to avoid detection.

How to protect yourself from card cloning

Card cloning is a serious threat to cardholders, and losses due to card fraud are increasing. Make sure to do the following to keep yourself safe from card cloning:

‘); hiddenDoc.close() } })();

Buy clone cards online discreetly free shipping

Important

Thieves have figured out how to target chip cards through a practice called shimming. A paper-thin device known as a shim can be slipped into a card reader slot to copy the information stored on a chip card.3

Example of Cloning

A popular method of cloning requires the installation of hidden scanners on legitimate card-reading devices such as gas station pumps, automated teller machines (ATMs), or the point-of-sale (POS) machines in retail stores.1

These attacks do not require the cooperation of the personnel working at those stores. The thieves just collect data on an ongoing basis from the hidden scanners, without the customers, employees, or business owners being aware of the breach.

How to Protect Yourself Against Credit Card Cloning

You can defend against credit card cloning by taking the following precautions:

Inspect a Card Reader Before Using It

Take a moment to inspect the card reader before you insert your card. If something looks suspicious, don’t use it.

Some skimming devices can be bulky. Others just look a little klutzy.1

Monitor Your Card Accounts

Monitor your credit card and bank accounts regularly for unauthorized purchases.

Check your balance and recent transactions online often, even daily.

Sign Up for Alerts

Most banks and credit card issuers allow you to sign up for alerts. You'll get an email or text message when certain activity occurs on your accounts, such as a withdrawal or a new charge exceeding an amount you specify.

Stick to Bank ATMs

Some ATM locations are more vulnerable than others. Gas stations and deli kiosks are favorite targets because the thieves can install their devices with less likelihood of being observed.

Your safest bet is to stick with an ATM that is inside a bank.

Use a Chip Reader

Always use a chip reader rather than swiping your card.

While cloning is still possible with a chip card, it is more difficult to pull off.

Opt for Contactless Payment

If your credit or debit card has a contactless payment feature, use it. Your card is more difficult to hack if it's not inserted into a terminal.

Fast Fact

Chip cards are also known as EMV cards—short for Europay, MasterCard, and Visa. These three companies collaborated to produce a global protocol for credit card security that is widely used today.

What to Do When Your Credit Card Is Cloned

If you believe your card has been cloned, your credit card company or bank should be the first call you make. The more quickly you cancel the card, the less time thieves have to rack up charges.

The good news is that consumers are not typically responsible for fraudulent charges. The Fair Credit Billing Act limits the liability to $50 if the theft is reported quickly.

Are Credit Cards with Chips Harder to Clone?

Yes, a card that uses a chip is more secure. The standard EMV chip technology uses a unique and encrypted code for every transaction you make. Most newly-issued cards have EMV chips and most terminals use the technology. They are not 100% safe, though. Stay wary.4

Are There Common Credit Card Scams Other Than Cloning?

Yes. The simplest way to use someone else's credit card illegally is to get hold of the physical card and pile up charges before the loss is discovered.

Other ways include pfishing scams by phone, email, or text. These usually come disguised as urgent communications from a legitimate company that you do business with.

Yet another tactic is the fake credit card application. A thief who has your personal information can apply for credit in your name.5

Who Investigates Credit Card Cloning?

The banks that issue credit cards, debit cards, and cash cards are the most active investigators of credit card cloning and other fraudulent activities related to credit. They have the most to lose.6

Credit card fraud is usually prosecuted by the states. Fraud that involves foreign players may be prosecuted by federal investigators.

The Bottom Line

Countless consumers have been victimized by credit card fraud. One of the most common types of fraud, credit card cloning, has become harder to pull off with the widespread adoption of EMV chip technology. That doesn't mean it's impossible. You can defend against credit card fraud by frequently checking your accounts for unauthorized charges or withdrawals, and alerting the issuer immediately if you see a problem.

Order Cloned ATM Bank Cards Online

Sponsored

Connecting with the right financial advisor doesn’t have to be difficult. With Unbiased, you can find an SEC-regulated, fiduciary advisor who is focused on your unique financial needs and goals. Simply complete an easy online form, get matched with an advisor, and schedule your free first meeting. Learn more about what expert financial advice can do for you, and get started today.

Card Cloning

What Is Card Cloning?

Credit card cloning or skimming is the illegal act of making unauthorized copies of credit or debit cards.

This enables criminals to use them for payments, effectively stealing the cardholder’s money and/or putting the cardholder in debt.

To do this, thieves use special equipment, sometimes combined with simple social engineering. Card cloning has historically been one of the most common card-related types of fraud worldwide, to which USD 28.65bn is lost worldwide each year – projected to increase to USD 38.50bn by 2023, according to Nilson Report.

How Does Card Cloning Work?

Card cloning is a fairly elaborate criminal scheme. More specifically:

- An accomplice is recruited – someone with physical access to credit cards e.g. a cashier, restaurant server etc.

- They are given a skimmer – a compact machine used to capture card details. This can be a separate machine or an add-on to the card reader.

- The customer hands their card to the accomplice, as payment.

- The accomplice swipes the card through the skimmer, in addition to the POS machine used for normal payment.

- The accomplice hands back the card to the unsuspecting customer.

- The thief transfers the details captured by the skimmer to the magnetic strip a counterfeit card, which could be a stolen card itself.

- The counterfeit card can now be used in the way a legitimate card would, or for additional fraud such as gift carding and other carding.

There are, of course, variations on this. For example, some criminals will attach skimmers to ATMs, or to handheld card readers. As long as their users swipe or enter their card as usual and the criminal can return to pick up their device, the result is the same: Swiping a credit or debit card through the skimmer machine captures all the information held in its magnetic strip.

Order Cloned ATM Bank Cards Online

Additionally, the thieves may shoulder-surf or use social engineering techniques to find out the card’s PIN, or even the owner’s billing address, so they can use the stolen card details in even more settings.

According to the Nilson Report, it’s projected to reach a staggering $38.5bn by 2027. So how do you detect credit card fraud?

Read Here

4 Ways to Prevent Card Cloning

Strategies deployed by the finance industry, authorities and retailers to make card cloning less easy include:

1. EMV microchips instead of magnetic stripes

These contain more advanced iCVV values compared to magnetic stripes’ CVV, and they cannot be copied using skimmers.

However, criminals have found alternative ways to target this type of card as well as methods to copy EMV chip data to magnetic stripes, effectively cloning the card – according to 2020 reports on Security Week.

Credit and debit cards can reveal more information than many laypeople might expect. You can enter a BIN to find out more about a bank in the module below:

Free BIN lookup!

Enter the first 6 or 8 digits of a card number (BIN/IIN)

Bank Name

Text here

Country

france

2. Customer profiles

By building customer profiles, often using machine learning and advanced algorithms, payment handlers and card issuers acquire valuable insight into what would be considered “normal” behavior for each cardholder, flagging any suspicious moves to be followed up with the customer.

A simple version of this is a consumer receiving a call from their bank to confirm they have swiped their card in a part of the country they haven’t been active in before.

3. Educating the public

Making the general public an ally in the fight against credit and debit card fraud can work to everyone’s advantage. Major card companies, banks and fintech brands have undertaken campaigns to alert the public about card-related fraud of various types, as have local and regional authorities such as Europol in Europe. Interestingly, it seems that the public is responding well.

In July 2021, industry insider Elena Emelyanova, Fraud Manager at Wargaming, explained in an episode of our Cat and Mouse Podcast:

“People have become more sophisticated and more educated. We have some cases where we see that people know how to fight chargebacks, or they know the restrictions from a merchant side. People who didn’t understand the difference between refund and chargeback. Now they know about it.”

4. Accountability, laws and regulations

Owing to government regulations and legislation, card providers have a vested interest in preventing fraud, as they are the ones asked to foot the bill for money lost in the majority of situations.

For banks and other institutions that provide payment cards to the public, this constitutes an additional, strong incentive to safeguard their processes and invest in new technology to fight fraud as efficiently as possible.

Actual legislation for this varies per country, but ombudsman services can be used for any disputed transactions in most locales, amping up the pressure on card companies. For example, the UK’s Financial Ombudsman received 170,033 new complaints about banking and credit in 2019/2020, by far the most frequent type, going on to state, in their Annual Complaints Data and Insight Report:

“We’ve been clear that we expect businesses to apply relevant rules and guidance – including, but not limited to, the CRM code. If complaints arise, businesses should draw on our guidance and past decisions to reach fair outcomes.”

Is Card Cloning Still a Threat?

With payment card issuers and networks ramping up security and introducing new technologies, and consumers getting savvier, card skimming is believed to be on the decrease, with counterfeit cards only amounting to 2% of card fraud losses in 2019 compared to 13% in 2010, per a 2020 report by UK Finance.

It seems that the focus has shifted to different methods, such as card not present (CNP) attacks and using NFC technology to obtain the details of contactless-enabled cards.

Nevertheless, this does not mean that card cloning has stopped. For instance, in January 2021 the debit card data of over 500 customers was stolen using card cloning in India. The authorities arrested four men and recovered three credit card skimmers, with which they had made payments of INR 150,000.

Together with its more recent incarnations and variations, card skimming is and ought to remain a concern for organizations and consumers.

Sources

- Nilson Report: Card Fraud Losses Dip to $28.58 Billion

- Security Week: Cybercriminals Could Be Cloning Payment Cards Using Stolen EVM Data

- European Association for Secure Transactions (EAST): Black Box attacks increase across Europe

- Europol: Payment Card Fraud Prevention Alert

- Financial Ombudsman Service UK: Annual complaints data and insight 2020/21

- Times of India: Card cloning: Data of 500 customers stolen,

- UK Finance: FRAUD – THE FACTS 2020

Card Cloning

Cards are essentially physical means of storing and transmitting the digital information required to authenticate, authorize, and process transactions. This information mostly consists of card numbers, the cardholder’s name, security codes, expiration date, and a few others. Unfortunately, criminals can replicate this information and use it to commit fraud.

What is card cloning?

Card cloning is the process of replicating the digital information stored in debit or credit cards to create copies or clone cards. Also known as card skimming, this is usually performed with the intention of committing fraud. Once a legitimate card is replicated, it can be programmed into a new or repurposed cards and used to make illicit and unauthorized purchases, or withdraw money at bank ATMs.

How does card cloning work?

The process and tools that fraudsters use to create counterfeit clone cards depends on the type of technology they are built with.

Cards can store and transmit information in three ways:

-

Magnetic Stripe

If you look in the back of any card, you’ll find a gray magnetic strip that runs parallel to its longest edge and is about ½ inch wide. This stripe uses technology similar to music tapes to store information in the card and is transmitted to a reader when the card is “swiped” at point-of-sale terminals.

Magstripe-only cards are being phased out due to the relative ease with which they are cloned. Given that they do not offer any encoding protection and contain static data, they can be duplicated using a simple card skimmer that can be purchased online for a few dollars.

-

EMV Chip Cards

If you look in the front side of most newer cards, you will also notice a small rectangular metallic insert close to one of the card’s shorter edges. This is an EMV (which stands for EuroPay, Mastercard, and Visa) microchip, which uses more advanced technology to store and transmit information every time the card is “dipped” into a POS terminal.

EMV cards offer far superior cloning protection versus magstripe ones because chips protect each transaction with a dynamic security code that is useless if replicated.

Sadly but unsurprisingly, criminals have developed technology to bypass these security measures: card skimming. Even if it is far less common than card skimming, it should by no means be ignored by consumers, merchants, credit card issuers, or networks.

-

Contactless Cards

The newest cards in the market today are equipped with a third way of storing and transmitting information through radio-frequency identification technology (RFID). This allows them to communicate with card readers by simple proximity, without the need for dipping or swiping. Some refer to them as “smart cards” or “tap to pay” transactions.

Contactless payments offer increased protection against card cloning, but using them does not mean that all fraud-related problems are solved.

All cards that include RFID technology also include a magnetic band and an EMV chip, so cloning risks are only partially mitigated. Further, criminals are always innovating and come up with new social and technological schemes to take advantage of customers and businesses alike.

Examples of Credit Card Cloning Fraud

1. Card Skimming

Fraudsters create devices known as card skimmers that attach to point-of-sale payment terminals—commonly gas pumps, ATMs, and merchant card readers. These skimmers steal card information and store it for fraudsters to use in cloning the card.

2. Carding

When fraudsters get stolen card information, they will sometimes use it for small purchases to test its validity. Once the card is confirmed valid, fraudsters alone the card to make larger purchases.

3. Data breaches

When fraudsters use malware or other means to break into a business’ private storage of customer information, they leak card details and sell them on the dark web. These leaked card details are then cloned to make fraudulent physical cards for scammers.

Order Cloned ATM Bank Cards Online

How big is the card cloning problem?

1.2 billion card transactions are performed worldwide every day (Statista), and massive amounts of money exchange hands through them. According to the FBI, skimming costs financial institutions and consumers more than $1 billion each year.

How to prevent card cloning?

- Use Chip-Enabled Cards: Using credit or debit cards with chip technology (EMV) instead of magnetic stripe cards makes it harder for fraudsters to clone your card.

- Avoid Suspicious ATMs: Look for signs of tampering or unusual attachments on the card insert slot and if you suspect suspicious activity, find another machine.

- Protect Your PIN: Shield your hand when entering your pin on the keypad to avoid prying eyes and cameras. Do not share your PIN with anyone, and avoid using easily guessable PINs like birth dates or sequential numbers.

- Check Your Bank Statements: Review your credit card and bank statements regularly to spot unauthorized transactions. Report any you find to your financial institution immediately.

Order Cloned ATM Bank Cards Online

- Beware of Phishing Scams: Be cautious about providing your credit card information in response to unsolicited emails, calls, or messages. Legitimate institutions will never ask for sensitive information in this way.